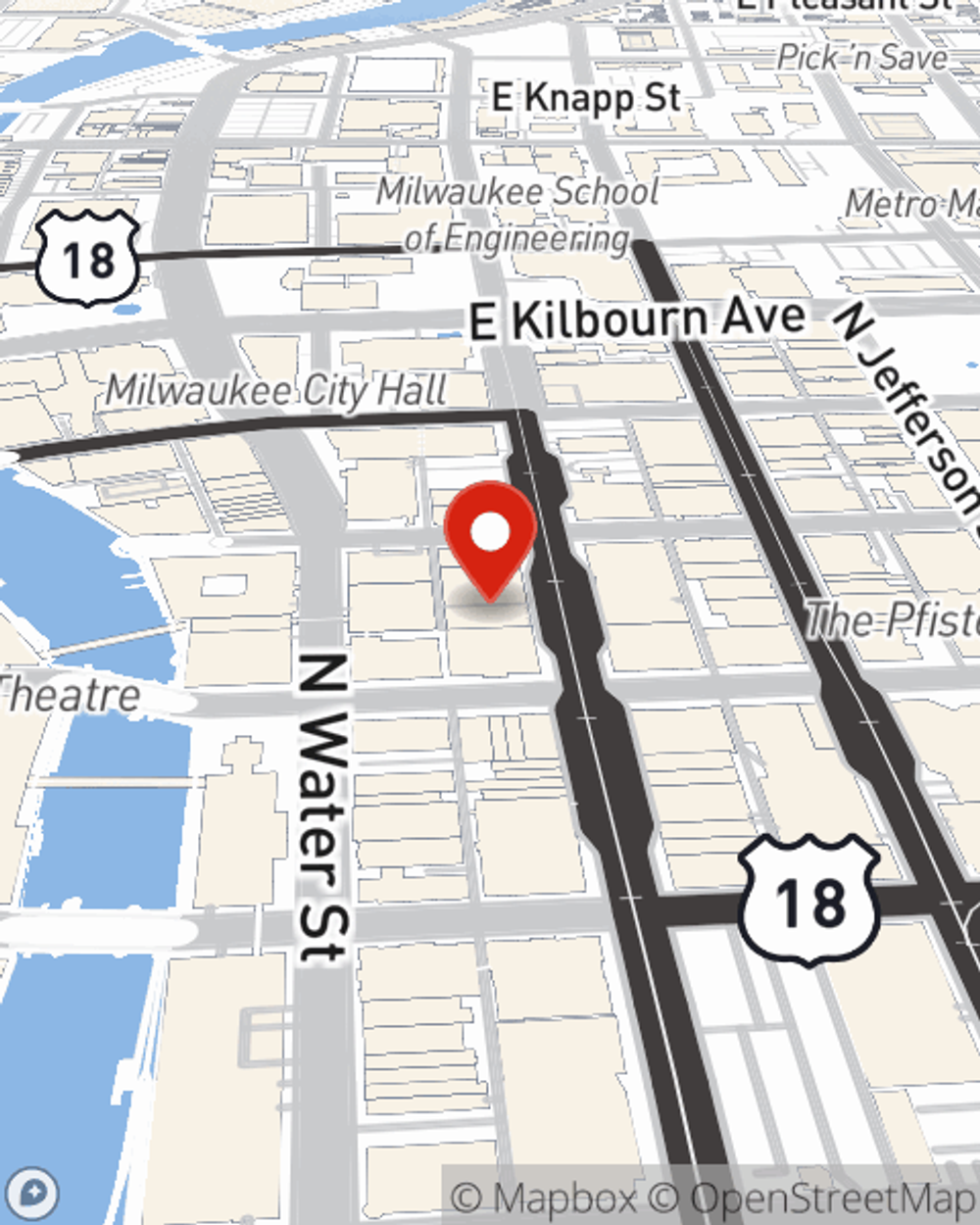

Business Insurance in and around Milwaukee

Get your Milwaukee business covered, right here!

Helping insure small businesses since 1935

Your Search For Reliable Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, business continuity plans and a surety or fidelity bond, you can rest assured that your small business is properly protected.

Get your Milwaukee business covered, right here!

Helping insure small businesses since 1935

Surprisingly Great Insurance

Your company is special. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just earning a paycheck or an office. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a variety of occupations like a taxidermist. State Farm agent Bob Vitt is ready to help review coverages that fit your business needs. Whether you are an HVAC contractor, a dog groomer or an insurance agent, or your business is a shoe repair shop, a camera store or a music school. Whatever your do, your State Farm agent can help because our agents are business owners too! Bob Vitt understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Bob Vitt today, and let's get down to business.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Bob Vitt

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".